Stay on top of your potential tax breaks to minimize your payments.

By Megan Arszman

Most professionals dread tax season, but your taxes should be on your mind all year long. Not only is there the need for extensive record keeping, but you also might question if something is a legit tax write-off or if you’ll get in trouble with it.

A tax write-off, or tax deduction, is a legitimate expense that lowers your taxable income on your tax return. And while you might think something is a tax deduction, it’s the IRS that ultimately determines which expenses can be considered legitimate or not. It must be connected to your business as an expense directly related to conducting your business.

When you file your tax return, the IRS will use your reported income, minus the tax deductions and credits to determine which tax bracket you should be in, which determines the tax rate your taxable income will be taxed. In short, the more deductions you have, the lower your reported income, thus the lower your taxable income and tax rate.

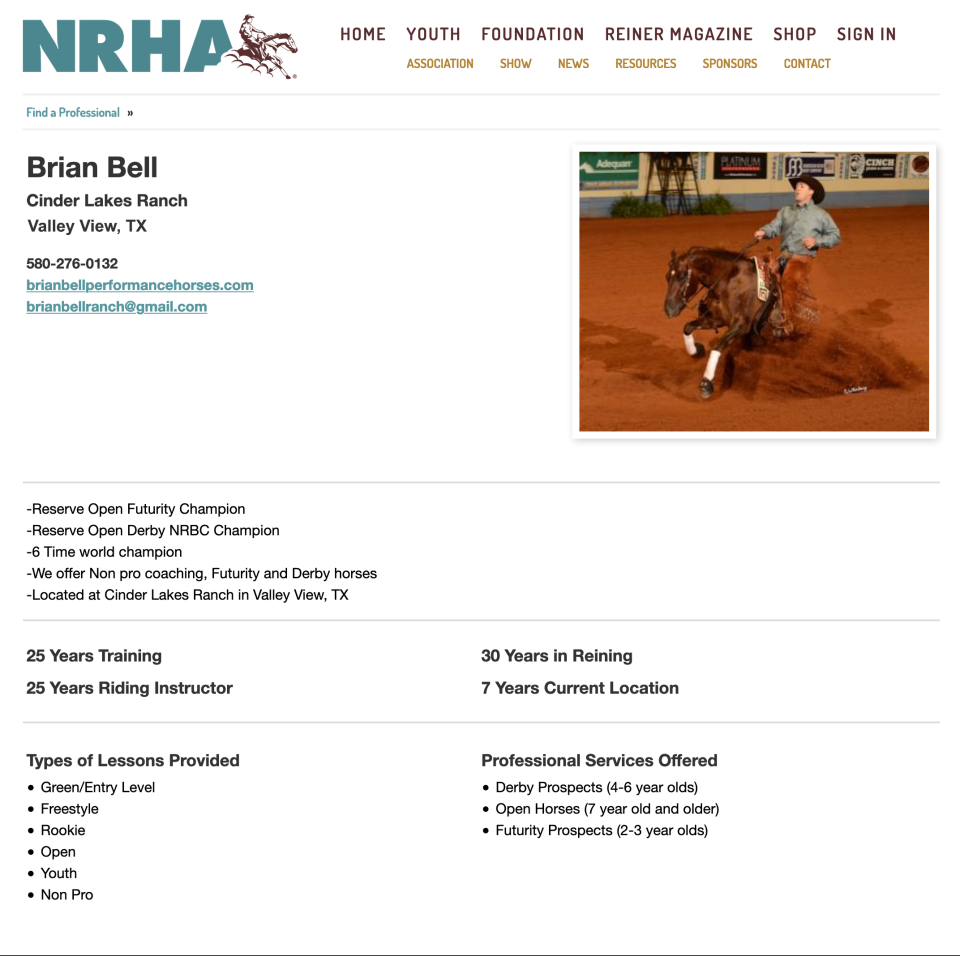

So, what can horse trainers write off for tax purposes? Bookkeeper and horsewoman Kristina Vaughn shares these tax tips for NRHA Professionals. Here are seven cut-and-dried answers to common write-off questions.

- Do you buy/rent your own practice cattle for training cutting or working cow horses? This is a deductible expense as long as you are sure to keep careful records for how they are being used and report the income from selling the old herd when you buy “fresh” cattle.

- Do you use your dog for security at the barn, which you own? Check with your tax professional to see if Fido’s vet bills can be considered tax-deductible.

- Is your business logo stitched on any gear (yours or someone else’s)? The show gear with your branding can be written off as marketing materials.

- Do you train your own horses to sell? The costs for developing the value of those horses and entering them in shows are fully deductible (care, show fees, stall rental, feed, grooming, vet, farrier, hotel, meals, tack and gear, etc.).

- Do you attend seminars and/or certification programs to enhance your education? As long as it pertains to bettering your business, these can be written off.

- What about the occasional dinner with clients while talking business? As long as the costs are reasonable and not extravagant, keep pristine records on with whom you dined, where you went, and the reasons for the dinner.

- Do you do your own bookkeeping and charge clients via third-party software (such as PayPal, Venmo, Stripe, Square, Zelle, etc.)? The payment processing fees are sure to add up as deductible expenses. These can be claimed.

In the training business, the lines often get blurred between personal expenses and business expenses. Which items are commonly written off that should not be written off for tax purposes—and can get you in trouble with the IRS? A couple of the top items that the IRS will target in the case of an audit include the following.

- Any dog/cat food and toys. Do not pay for your pet expenses from your business account and write it off. Purchasing these items while purchasing horse feed, supplements, and bedding? Do a separate transaction. Do a separate transaction, do not pay for your pet expenses (or anything else not business-related) from your business account and think you’re pulling one over on the tax man. They’ll eventually get you.

- If your business is to train and sell horses for owners, note that your own personal horses and related expenses (boarding, feed, tack, show boarding, show entries, etc.) are not deductible and are not related to the income producing activities of your business.

- If you have workers who are not legal to work within the United States, writing this labor expense off on your taxes can be risky business and can potentially bring hefty fines from various authorities.

No. 2 above might seem confusing, because in No. 4 in the first part of the article conflicts with it. The distinction is that if you’re competing on a horse owned by you that’s meant for resale in the future, then the costs for this horse are deductible. If the personal show horse is not meant to be sold in the future, there are a few questions that need to be asked to determine if expenses incurred for the horse are deductible:

- Is there prize money to be earned in the competition and reported as income?

- Does the income from prize money earned justify the costs incurred to keep and train the horse?

- Can the argument be made that you use various competition performances on your own animal to establish your name/business in the industry (this could be answered by determining the previous question)?

If the answer is yes to the questions above, then the costs of your own horse can be deductible. If the answer is no to the above questions, then expenses associated with your personal horse should not be claimed. As always, seek the advice of a tax professional when working through these situations.

What About the “Hobby Loss Rule?”

This rule, in terms for breeding, training, and showing horses, your business needs to have a profit in two or more of the taxable years in a period of seven consecutive tax years. If you’re keeping this rule in mind, do not include unrelated income on your tax return just to offset your equine business losses. In the case of an audit, this will be examined.

The Write-Off

Record any large purchases in your books as assets, and then depreciate them to spread your tax savings over several years. Don’t take these to be expensed, warns Vaughn. The typical safe harbor for fixed assets is $2,500. This includes vehicles, trailers, horses, fencing, round pens, mowers, etc. You would be surprised how many people either do this incorrectly or just forget to consider these at all.

“As with any and all financial transactions related to your business, keep your receipts and documentation for proof,” stresses Vaughn.

This article is provided for informational purposes only and does not constitute individualized financial advice.

About the Expert

Kristina Vaughn is the owner of Legit Ledgers, LLC, a bookkeeping business that specializes in serving only professionals in the equine industry. Legit Ledgers is a 100% virtually run business and caters to the needs of horse businesses nationwide.