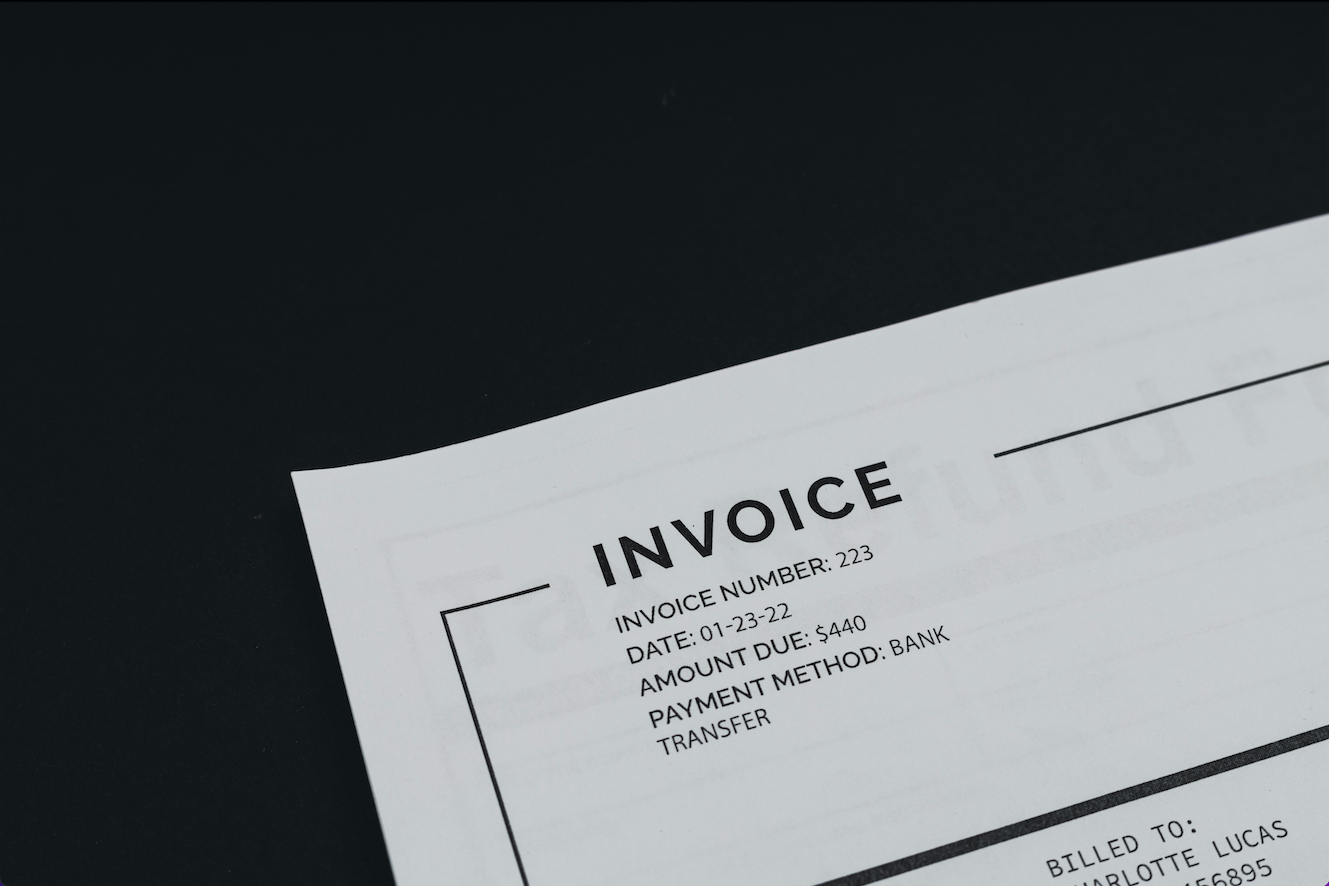

Too much information can confuse customers. Even the most basic invoices should include the following pieces of information.

By Katie Navarra

When’s the last time you took a close look at your customer invoices? It’s a good idea to regularly check that everything is up-to-date, accurate, and representative of your business and its culture.

THE AMOUNT DUE. As obvious as it sounds, it’s a good reminder to make sure that every invoice you create includes the exact amount the client owes in an easy-to-find fashion.

THE DUE DATE. Getting paid is only one part of the equation. Getting paid in a timely manner is the other. Clearly communicate when you expect the invoice to be paid. For example, “Bill due in 30 days from invoice date” or indicate a specific due date rather than a number of days into the future.

THE INVOICE DATE. Identify when you create the invoice. This helps you obtain payment in a timely fashion and is good for your records.

AN INVOICE NUMBER. A unique invoice number allows you to track payments received and outstanding bills.

DESCRIPTION OF SERVICES. Be transparent and thorough about what you’re charging for. In addition to listing “Training Services,” say, “30-days training, which included 5 rides each week, plus turnout and feed/hay.” If your training fee doesn’t include daily care in the flat rate, a second line can state, “Daily Care: Includes hay/feed, stall cleaning, and turnout.” Elaborate on additional services performed so clients understand exactly what they’re paying for. This might include time on the vibration plate or a laser treatment, blanket changing, etc.

CONTACT INFORMATION. Include an address, phone number, and email for both you and your client.

LOGO. If you have a logo, it’s a nice touch and supports your business brand, but isn’t a necessity.

TAXES. Some trainers build taxes into a flat rate for services knowing that at the end of the year a percentage of their income will be directed to taxes. Others choose to add taxes on top of the flat fee. If you choose to do this, include a line and indicate the tax rate you’re charging. Ask an accountant for the best approach for your business.

THANK YOU FOR YOUR BUSINESS. Let your customers know you appreciate their business with a brief note of thanks.

1099 REPORTING. Clients may need your tax ID number for 1099-reporting purposes. It can be helpful to include this information on the invoice. An accountant can provide guidance on how this may/may not affect your business.

LATE FEES. If you charge a fee for late payments, it’s worth including a one-sentence notification on the invoice. “Bills not paid within 30 days will be assessed a 10% late fee,” for example.

This list sounds like a lot of information to include on a “simple” invoice but by being thorough, you build trust with your customers.