Prepare for your future with tailored retirement plans for each stage of your career.

By Carrie Volmer, With Alexis Bennett

IRAs, mutual funds, HSA and FSA accounts, tax deductions, and life insurance—planning for your future can be overwhelming. Unlike regular full-time employees who have human resource offices and pamphlets to peruse, as a horse trainer you’re often left to navigate retirement planning on your own. While the freedom of owning your own business comes with its own perks, this area can feel daunting, and as a result is often neglected.

In this three-part series, you’ll learn about three phases of financial planning:

Part 3: The Out-to-Pasture Plan

The Futurity Plan

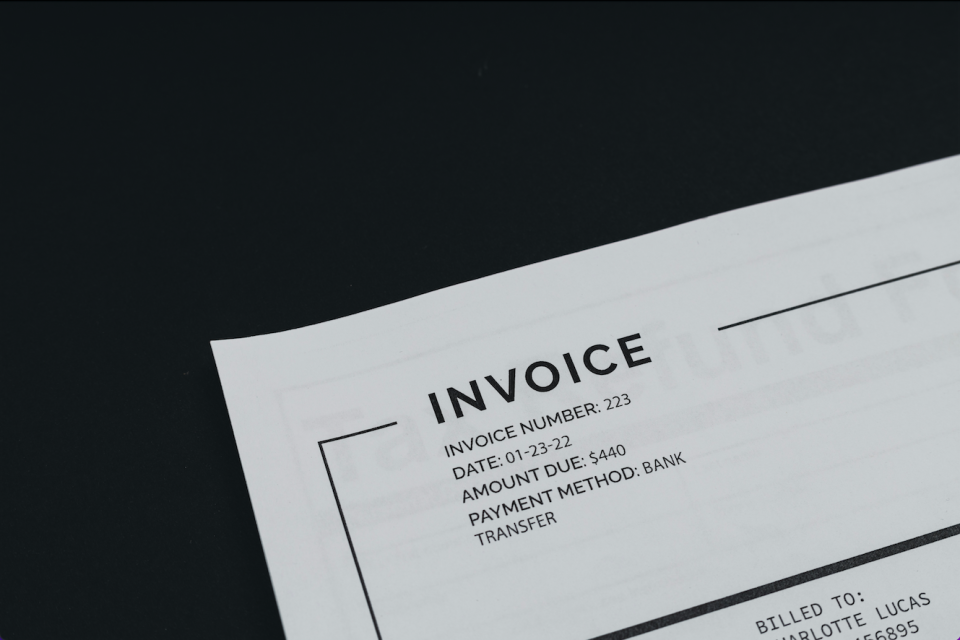

This is the trainer who’s just starting out, usually 20 to 30 years old who’s working under a more seasoned trainer or has just ventured out on his own. If you invoice less than $20,000 per month, this might be your business.

After you pay for feed, fuel, entry fees, and take care of everyday expenses, such as your own groceries and electricity, the thought of contributing to investments seems unreasonable. You likely face financial planning with dread and an “I’ll get to that later” attitude. At this point in your career, proactive financial planning has the greatest benefit. You can afford to take greater investment risks, so you enjoy higher returns and give your account time to grow.

Investing: Set up automatic deductions from your primary account to be placed in an investment brokerage account. Err on the aggressive side of investing, choosing a portfolio that includes a higher percentage of stocks to bonds, 80 to 20 percent. These accounts average a seven- to eight-percent return each year.

Unlike many pre-tax IRAs, such as a Traditional IRA, with individual investment accounts there’s no penalty for accessing funds prior to a specified age. This is helpful in the event of a true emergency where you need backup funds.

Healthcare: You might choose to forgo medical coverage because you’re healthy and don’t foresee medical expenses in the immediate future. Unexpected medical bills can seriously derail your financial future, and healthcare systems can offer little support for the uninsured.

Ideally, you’ll be covered under a spouse’s plan. If this is the case, and you’re a relatively healthy individual without pre-existing conditions, choose a low-cost, high-deductible plan with a Health Savings Account (HSA). You can also choose an individual account through the Healthcare Exchange with the same options, but it can be expensive for trainers starting out. There are other more affordable options to consider.

Medical share plans tend to be cheaper options to cover you or your family. Many are offered through Christian-based faith organizations. With these plans, you pay all of your healthcare expenses upfront, but you can then file a claim for reimbursement, usually at 100-percent coverage. This works well if traditional coverage costs too much and you can afford to wait for reimbursement.

Other assurances: As you know, with horses, anything can happen. A life insurance policy protects your family in the event that something happens to you, even if it’s not horse-related. A term insurance plan, designed to last for a certain number of years, is usually the most affordable option. A million-dollar life insurance policy, if you’re relatively young, healthy, and meet other qualifications, usually costs between $50 and $60 per month.

Find the rest of this article at the links above.