How can collaboration, shared experiences, and learning from each other’s experiences enhance your business? One ‘group study’ expert (who’s also a reiner) shares her insights here. By Jennifer Paulson

You work in an inherently competitive industry. Show-pen success and NRHA Lifetime Earnings aside, you vie for horseflesh, customers, sponsors, and more to keep your business moving in a positive direction and your revenue numbers growing. So it might seem as if collaborating with fellow NRHA Professionals on matters of busines would be counterproductive to your goals.

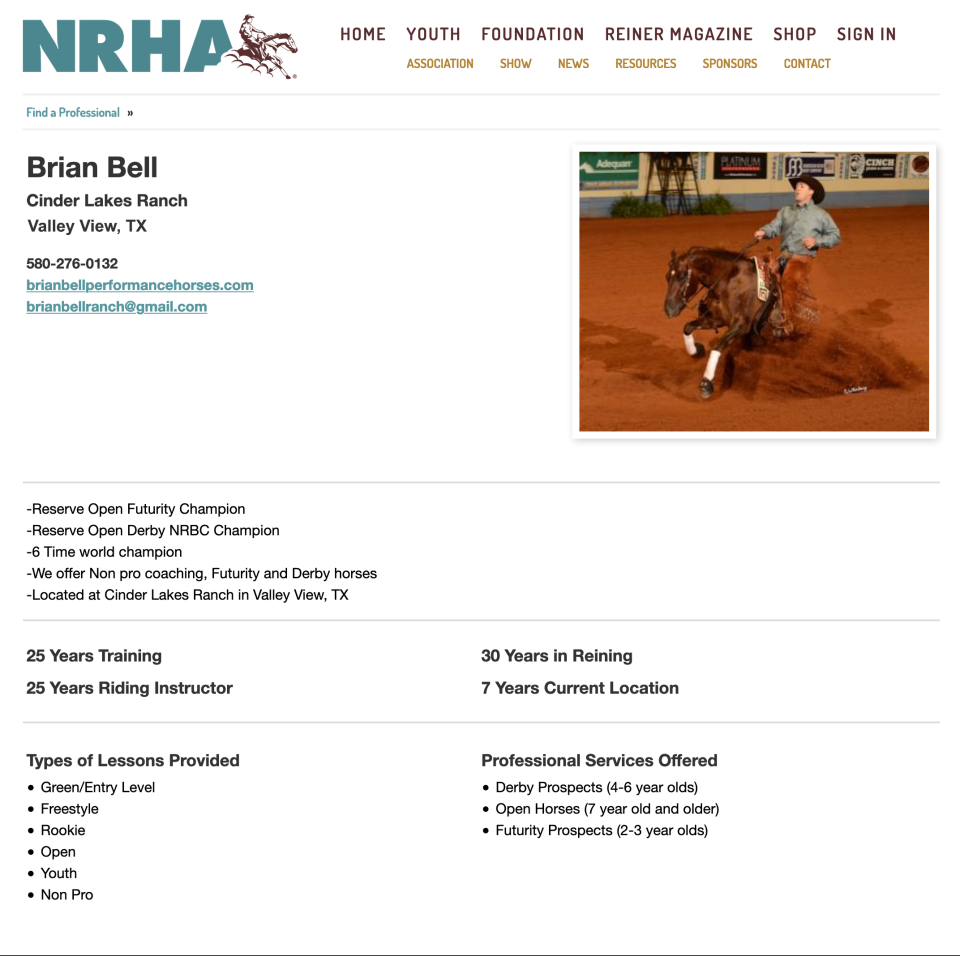

Dr. Marsha Heinke, EA, CPA, CVPM disagrees and has experience to support collaborative efforts. The Grafton, Ohio, reiner owns and operates Veterinary Practice Made Perfect, a firm that provides business consulting, accounting, and tax advice to veterinary practices. Additionally, she’s involved with Veterinary Management Groups, which is where small groups of veterinarians come together to learn from each other—through both triumphs and failures—to improve their business practices in everything from accounting and personnel management to regulations and taxes.

Called “study groups” or “groups of 20,” these collaboratives haven’t yet been developed in the horse industry that we know of. However, Heinke’s insights and key learnings from working with veterinarians can open your mind and your eyes to the opportunities that lie within collaborative group work.

Learn about these topics from Heinke:

Part 1: A Little History and Keys to Success

Part 3: How a Group Could Help You

Legal Standards

This is where things can get complicated and why a CPA must be part of your work with a study group, even if it’s not in a highly structured method such as those the Veterinary Study Group uses. Things can get dicey legally when members of the same industry, working in the same geographic area, meet up to discuss business practices. From the outside, and even to government entities, it can seem as though the members of the group are price-fixing, colluding, and working against their clientele.

“In the vet industry, there’s a real effort to have group members live a far distance from each other,” Heinke explains. “They’re not competing for the same handful of clients in their own backyard. This helps avoid trouble with the Federal Trade Commission (FTC) in areas such as setting prices and employee compensation. An umbrella organization or leader helps keep you on the straight and narrow. Having dues and an organizational structure sets up your group as a business.”

Heinke notes that smaller groups could work through an accounting firm in a similar manner, but members need to plan to compensate the organizer for the large investment of time and effort, as well as to pay the experts who share with the group.

Read the rest of this article at the links above.