Illnesses, accidents, and emergencies can leave a horse’s future in limbo. Whether it’s your own horses or your client’s horses, planning for the worst-case scenario ensures that horses are taken care of in your absence.

By Katie Navarra

It’s human nature that we don’t like to consider our own mortality. It’s just too morbid. Yet, we all know that life can be unpredictable. In a split second, a disease, a car accident, or an act of nature can alter or end a person’s life. Such circumstances can leave the injured, ill, or deceased individual’s horses in limbo.

“Emergency decisions are made in supremely stressful situations that are not conducive to rational decision-making,” said Denise Farris, a Kansas-based attorney who specializes in equine law. “Sadly, many of these horses left behind are turned out to pasture or go to persons or entities that’d not be the first choice of the departed owner.”

Quick decisions in these situations can have unforeseen consequences or negative results.

“Isn’t it much better to control the future of a valued horse, rather than leaving it to chance?” she asked.

As if planning for an unexpected death isn’t challenging enough, trainers are burdened with considering the matter from two perspectives: One as a personal horse owner and the other as business owner responsible for someone else’s horse, said attorney Peggy R. Hoyt, a horse owner and the author of All My Children Wear Fur Coats.

“A trainer has to consider what happens to a horse when a client dies,” she said. “You need to know how you’re going to get paid, where the horse is going to go, and you may even want the first right of refusal to buy the horse.”

It’s more productive to evaluate these decisions before an emergency arises. This allows for options to be weighed in a mindful and deliberative manner so that bad decisions can hopefully be avoided. Advanced planning provides the opportunity to create a safety net. This ranges from lining up contingency plans to setting aside finances and securing the consent of all the parties involved.

In this four-part series, we’ll cover:

Part 1: Pets and Estate Planning

Part 3: Creating a Trust or Will

Part 4: Saving for Long-Term Care

Creating a Trust or Will

A trust is a written statement that outlines how you’d like your horses to be cared for if you become ill or die. A trust includes information such as feeding regimens, conditioning, training level, special health needs, etc. and only lasts until the horse dies. When a trust covers more than one horse, it terminates upon the last horse’s death.

A trust names a “guardian” or trustee of the estate. “This is someone willing to oversee both the animal’s caretaker as well as disposition of the funds,” Farris said. “Line up successor plans as well, in the event that your initial designee is unable to serve.”

Creating a specific trust document is more expensive than a will. However, it’ll permit you to name a caregiver, direct funds to that caregiver, and condition disbursement of those funds per specific terms and conditions, she said.

“Depending on your state’s laws, you may be able to either create a trust fund specifically for your pet, or in your will create a funding directive that’ll provide for a designated caretaker’s costs in caring for your animal until its death,” Farris explained.

If the funding directive is set up as a form of trust, you can also create insurance that’d name the trust as a beneficiary upon your death.

An alternative to a trust is to designate long-term care instructions within your will. “Understand that under a will, the money goes directly to the pet’s caregiver who can either use it for the pet or use it for themselves with no legal recourse. Therefore, naming a trusted caregiver is key,” she said.

In either scenario, it’s critical to work with local estate and trust attorneys. Ask them specifically if they have done prior wills or trusts that establish long-term care and funding instructions for animals of the deceased.

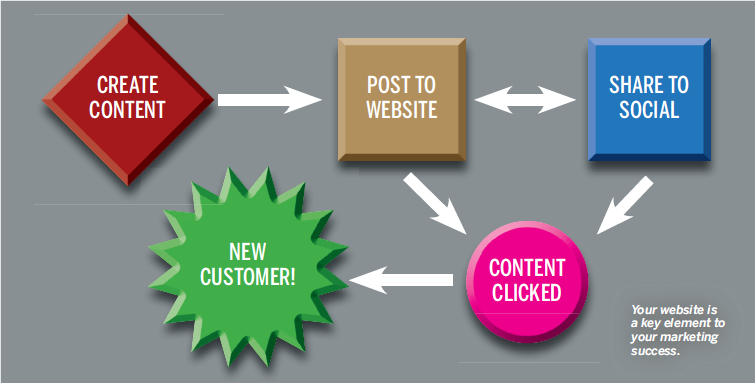

Hoyt recommends an online planning service to help trainers and horse owners start the process.

Conclusion

Estate planning can be daunting. No one wants to dwell on worst-case scenarios. Taking the time to have uncomfortable conversations without the pressure of life-altering circumstances looming means you’ll have an opportunity to thoroughly weigh your options.

“If you truly love and value your horses, and you’re unsure of your heir’s ability to recognize your wishes concerning the disposition of your horses upon your death, then it’s much better to have a plan in place that you’ve created,” Farris said.

Hoyt added that even if you or your client don’t establish a trust, spend time thinking about what happens to the horses in the event of tragedy.